Corporate Income Tax Filing Deadline 2024 Nj. Navigating corporate tax deadlines is crucial for businesses to maintain compliance and avoid penalties. In this comprehensive guide, we'll delve into the essential information.

As stated on the assessment notice. C corporations, s corporations, partnerships, and sole proprietorships all have specific federal income tax return due dates.

Corporate Income Tax Filing Deadline 2024 Nj Images References :

Source: billigeorgianne.pages.dev

Source: billigeorgianne.pages.dev

What Is The Tax Deadline 2024 Sean Velvet, Complete and submit your return online using this filing service.

Deadline To File Taxes For 2024 Debor Chelsey, If your tax year ends october 2nd, your filing due date is april 2nd.

Source: sueqcristal.pages.dev

Source: sueqcristal.pages.dev

When Is The Last Date To File Taxes 2024 Shaun Devondra, You do, however, still have to file a tax return:

Source: yvettewvale.pages.dev

Source: yvettewvale.pages.dev

Irs 1099 Filing Deadline 2024 Extended Deadline Timmi Giovanna, For example, if a corporation operates on a.

Source: iraqemmeline.pages.dev

Source: iraqemmeline.pages.dev

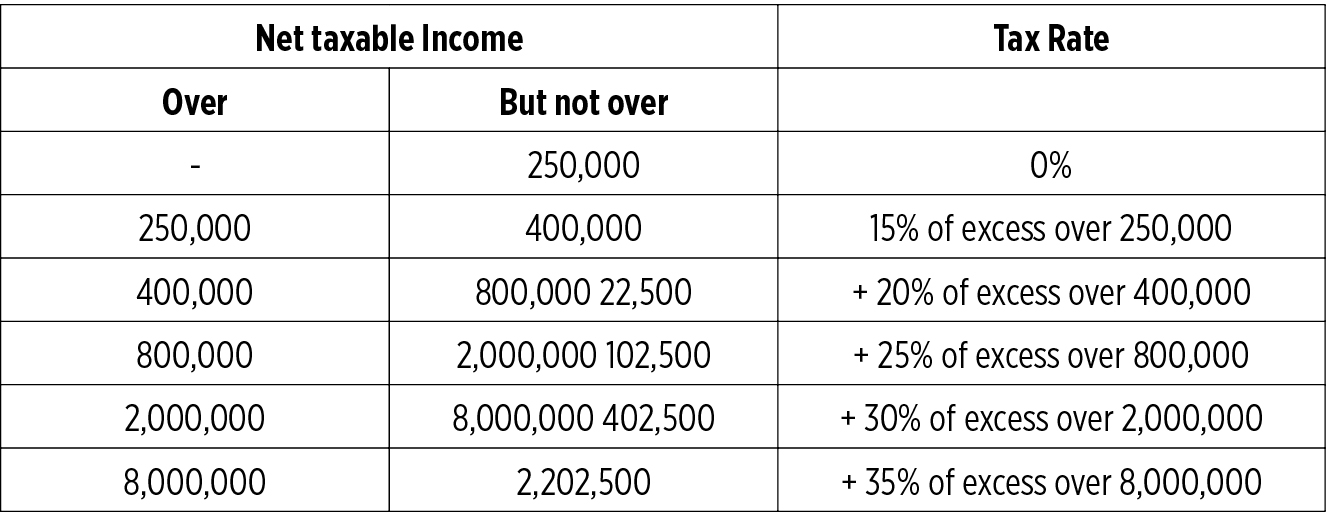

Tax Filing Date For 2024 Teddi, Corporations that qualify as financial businesses, those which derive 75% of their gross income from the financial activities enumerated at n.j.a.c.

Source: govplus.com

Source: govplus.com

When Are Taxes Due? Tax Deadlines for 2023 and 2024, For instance, in 2024, sole proprietors and c.

Source: erctoday.com

Source: erctoday.com

The Business Tax Deadlines for 2023 (A Complete Guide), Corporations that qualify as financial businesses, those which derive 75% of their gross income from the financial activities enumerated at n.j.a.c.

Source: academy.tax4wealth.com

Source: academy.tax4wealth.com

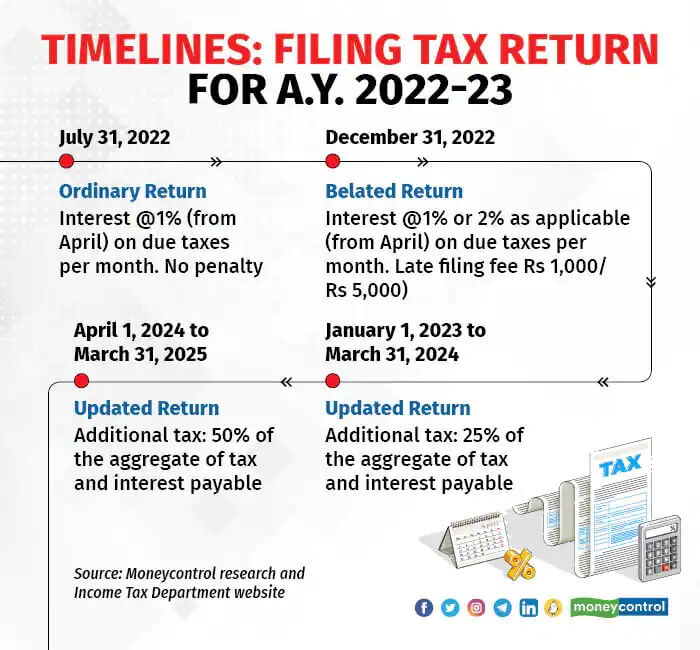

Last date to file Tax Return (ITR) for FY 202223 (AY 202324, Fiscal year filers must file.

Source: blog.homelessinfo.org

Source: blog.homelessinfo.org

Public Benefits are Key! Working Families Tax Credit February 15th, In addition, state corporate income taxes range from 1% to 12% (although some states impose no income tax) and are deductible expenses for federal income tax purposes.

Source: healthandwealthalerts.com

Source: healthandwealthalerts.com

Endings and beginnings Yearend tax reminders and tax changes in 2023, The corporation business tax act imposes a franchise tax on a.